LIC New Jeevan Mangal Plan 819 Calculator

Micro-Insurance Term Assurance Plan with Return of Premiums

UIN: 512N287V01

Launch Date: 09/01/2014 | Withdrawn: 01/04/2016

📋 Plan Features

📊 Calculation Results

Sum Assured

₹0

Policy Term

0 Years

Maturity Age

0 Years

Premium Mode

-

Premium Per Installment

₹0

Yearly Premium

₹0

Total Installments

0

Total Premium Paid

₹0

💰 Maturity Benefit (Sum Assured on Maturity)

₹0

🎯 Death Benefits

₹0

Higher of Sum Assured or 105% of Total Premiums Paid

₹0

Death Benefit + Additional Amount Equal to Sum Assured

The LIC New Jeevan Mangal Plan 819 is a popular micro-insurance product by the Life Insurance Corporation of India, designed specifically for low-income individuals who seek life cover at affordable premiums.

LIC New Jeevan Mangal Plan 819 Overview

LIC New Jeevan Mangal Plan 819 is a term insurance plan that combines pure protection with a unique return of premium feature. You pay small premiums at regular intervals, and if you survive the policy term, most of your premiums are returned, while the family receives a lump sum in case of the insured’s unfortunate demise during the term.

Launch Date and Withdrawal Date

- Launch Date: 16 May 2014

- Withdraw Date: 30 November 2017

The plan was available for purchase for over three years and catered extensively to rural and urban customers with flexible premium payment options.

Features and Benefits

Key Features

- Pure protection-based micro-insurance plan

- Return of premium on survival till maturity

- Flexible premium payment: lump sum, regular, or limited

- Minimum and maximum sum assured options

- Quick policy processing and minimal documentation

Major Benefits

- Death Benefit: Family receives the sum assured if the insured passes away during the term.

- Maturity Benefit: If the policyholder survives the term, all paid premiums (excluding taxes and extra charges) are returned.

- Affordable: Designed for daily wage earners, making life insurance accessible to all.

Who Should Consider LIC New Jeevan Mangal Plan 819?

This plan is ideal for:

- Individuals with irregular or low incomes

- Daily wage workers, rickshaw pullers, small vendors

- Rural and urban populations looking for basic life cover.

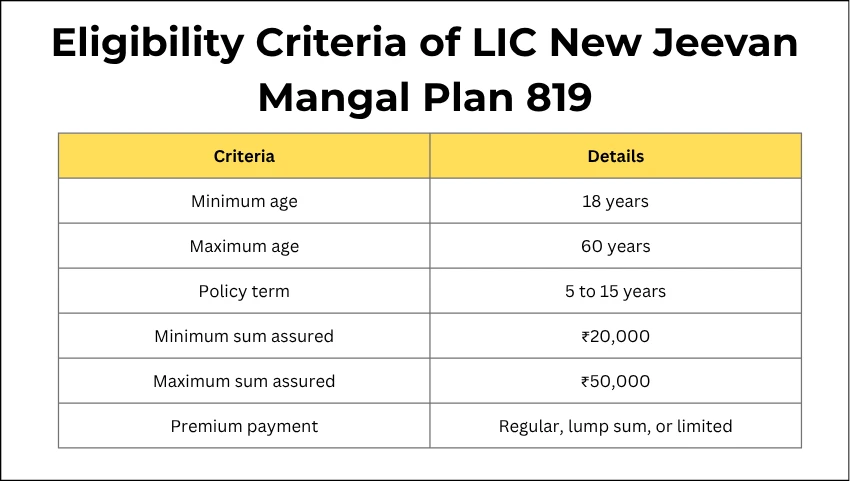

Eligibility Criteria

| Criteria | Details |

|---|---|

| Minimum age | 18 years |

| Maximum age | 60 years |

| Policy term | 5 to 15 years |

| Minimum sum assured | ₹20,000 |

| Maximum sum assured | ₹50,000 |

| Premium payment | Regular, lump sum, or limited |

The plan ensures flexibility in both payment and eligibility, making it a preferred option for people who may not have regular sources of income.

LIC New Jeevan Mangal Plan 819 Calculator: How It Works

To make informed decisions, users can utilize a dedicated calculator tool for LIC New Jeevan Mangal Plan 819. The calculator provides estimates for:

- Yearly or monthly premium amount

- Total premiums paid over the term

- Expected return of premium on maturity

- Death benefit value

Steps to Use the Calculator

- Enter Sum Assured: Input the life cover you wish to opt for (e.g., ₹20,000, ₹30,000, up to ₹50,000).

- Choose Policy Term: Select desired policy duration (between 5 and 15 years).

- Age Entry: Fill in your current age (should be between 18 and 60 years).

- Premium Payment Frequency: Choose payment option—regular, lump sum, or limited.

- Receive Calculation: The calculator displays yearly/monthly premium, maturity benefit, and death benefit instantly.

Sample Calculation Table

| Age | Policy Term | Sum Assured | Monthly Premium | Death Benefit | Maturity Benefit |

|---|---|---|---|---|---|

| 25 | 10 years | ₹30,000 | ₹87 | ₹30,000 | ₹10,440 (all premiums) |

These numbers are indicative; actual premium amounts may vary based on LIC’s rates and the calculator algorithm.

Detailed Plan Structure

Premium Payment Options

Users can pay premiums in three ways:

- Regular: Pay throughout the policy term.

- Limited: Pay for a few years, enjoy coverage for longer.

- Single Lump Sum: One-time payment for whole-term coverage.

Death Benefit Details

- On the insured’s death during the term, the family gets the full sum assured.

- No additional bonuses or profit sharing apply.

- The plan covers accidental and natural death.

Return of Premium on Maturity

If the insured survives the term:

- All paid premiums, excluding taxes and rider charges, are returned.

- No profit sharing or bonuses.

- A unique feature ensuring the policyholder gets most of their investment back.

How to Buy LIC New Jeevan Mangal Plan 819

Although the plan has been withdrawn (after November 2017), understanding the process helps in choosing similar current LIC plans.

- Contact LIC Agent or Visit Branch: Approach a trusted LIC agent or visit an LIC office.

- Fill proposal form: The form includes basic personal and financial details.

- Documentation: Submit KYC documents, proof of income, and age.

- Medical Examination (if required): For higher sum assured or older applicants.

- Payment: Choose the premium payment option; pay the first premium.

- Policy Issuance: LIC provides a policy bond, and coverage starts.

Common Use Cases

- Farmers and daily wage workers seeking financial security for families

- Small shopkeepers ensuring family protection

- Urban poor who want risk-free insurance

- Self-employed individuals without regular income

The plan’s flexibility and affordability made it a favored choice across India’s underserved demographics.

Step-by-Step LIC New Jeevan Mangal Calculator Guide

Here is how you can quickly calculate your premium for LIC New Jeevan Mangal Plan 819:

Step: Define Your Sum Assured

- Select a sum assured between ₹20,000 and ₹50,000.

Step: Enter Your Age

- Input your current age, making sure it is between 18 and 60 years.

Step: Choose Policy Term

- Decide on a policy term (from 5 to 15 years).

Step: Select Premium Frequency

- Opt for single, yearly, half-yearly, or monthly payment as per convenience.

Step: View Premium Details

- The calculator displays the expected periodic premium and maturity benefit.

User Example Scenario

Ram, a 30-year-old shopkeeper, opted for a sum assured of ₹30,000 with a 10-year term. Using the calculator, he finds his monthly premium is ₹87. If Ram survives for 10 years, he gets back ₹10,440 (all his paid premiums). If he unfortunately passes away before 10 years, his nominee receives ₹30,000.

Benefits of Using Calculator Tools

- Accurate Premium Estimates: Helps in planning and budgeting.

- Transparency: Ensures clarity on what users will pay and receive.

- Convenience: No need for manual calculations or visiting LIC offices.

- Instant Results: Allows for comparison with other micro-insurance plans instantly.

Frequently Asked Questions

What is LIC New Jeevan Mangal Plan 819?

LIC New Jeevan Mangal Plan 819 is a micro-insurance term plan with a return of premiums on maturity, designed to provide financial protection to low-income individuals and their families.

What benefits does this plan offer?

It offers two main benefits: a life cover (sum assured) in case of the policyholder’s death during the term and a return of the total premiums paid (excluding taxes) on survival till the end of the policy term.

Is there an accidental death benefit?

Yes, the plan includes an in-built accidental benefit where an additional sum assured (equal to the basic sum assured) is paid in case of death due to an accident.

What is the sum assured under this plan?

The sum assured ranges from ₹50,000 to ₹2 lakhs as per the plan’s eligibility criteria and options chosen.

Can this plan be revived if it lapses?

Yes, a lapsed policy can be revived within 2 years from the date of the first unpaid premium by paying outstanding premiums plus interest.

Conclusion

The LIC New Jeevan Mangal Plan 819, though withdrawn, served as a crucial micro-insurance scheme for India’s low-income populace. Its dual protection and risk-free return of premium structure made it a safe product. Using online calculators for premium and maturity benefit estimation enables better financial planning and helps choose similar plans from the current LIC offerings.