LIC Bima Kavach Plan 887 Calculator

Non-Par, Non-Linked, Pure Term Insurance Plan

UIN: 512N207V01Premium Details

Death Benefit Details:

Plan Features:

- Entry Age: 18 to 65 years

- Maximum Maturity Age: Up to 100 years

- Minimum Sum Assured: ₹2,00,00,000 (2 Crores)

- Policy Term: 10 to 82 years

- Special rates for women and non-smokers

- High Sum Assured Rebate available

- Tax benefits under Section 80C and 10(10D)

Level Sum Assured

Fixed death benefit throughout the policy term

Increasing Sum Assured

Death benefit increases by 10% annually from year 6 to year 15, then becomes 2X

Flexible Payment

Single, Limited (5/10/15 years), or Regular premium payment options

LIC Bima Kavach Plan 887 is a simple term insurance plan from Life Insurance Corporation of India. It gives high life cover to protect your family if something happens to you.

What is LIC Bima Kavach Plan 887?

LIC Bima Kavach Plan 887 with UIN 512N207V01 is a pure risk term plan. It means no maturity benefit or savings, just death cover during the policy term. Your family gets a large sum if you pass away while the policy is active.

Launched recently, this plan offers coverage up to age 100 years. Minimum sum assured starts at Rs. 2 crore. It suits people who want affordable premiums for big protection.

Women get special lower rates. Smokers pay more than non-smokers. You can add riders for extra accident cover.

Key Features of the Plan

This plan has flexible choices to fit your needs.

- Two Death Benefit Options: Option I keeps the sum assured level all through. Option II increases it by 10% each year from year 6 to 15, doubling the basic amount.

- Life Stage Benefit: Increase cover without new medical tests at marriage or child’s birth. Up to two increases, max Rs. 1 crore extra.

- Premium Payment Modes: Single pay, regular pay, or limited pay (5, 10, 15 years).

- Instalment Payout: family can take the death benefit in 5, 10, or 15 yearly parts.

- High Sum Assured Rebate: Lower premiums for covers over Rs. 2 crore, like 1.75% to 3.5% discount based on age.

No loan or surrender value except for some unexpired premium in single/limited pay cases.

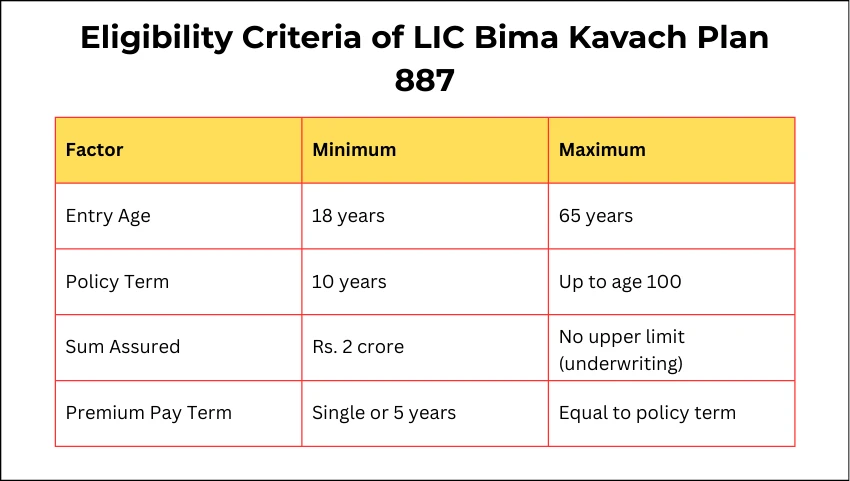

Eligibility Criteria

Anyone between 18 and 65 years old can join. Policy runs till age 100 max.

| Factor | Minimum | Maximum |

|---|---|---|

| Entry Age | 18 years | 65 years |

| Policy Term | 10 years | Up to age 100 |

| Sum Assured | Rs. 2 crore | No upper limit (underwriting) |

| Premium Pay Term | Single or 5 years | Equal to policy term |

Depend on age, health, and smoking for exact terms. Women and non-smokers get better rates.

Premium Payment Options Explained

Choose how you pay to match your cash flow.

Regular Pay: Pay every year till the policy ends. Best for steady income.

Limited Pay: Pay for 5, 10, or 15 years only. The cover continues longer.

Single Pay: One-time payment. Quick and simple.

Premiums exclude taxes. The grace period is 30 days. Revival is possible within 5 years.

Death Benefits in Detail

The main payout happens on death during term.

- Option I (Level): The basic sum assured stays the same. Life stage adds to it.

- Option II (Increasing): Same till year 5. Then +10% yearly till double at year 15. Stays double after.

The sum assured on death is the highest of 7x the annual premium, 105% of total premiums paid, or the absolute amount.

No maturity payout. Suicide within 12 months gives 80% of premiums back.

Life Stage Benefit: How It Works

Great for young buyers planning a family.

- Marriage: Increase by 25% of basic sum, max Rs. 50 lakh. Once only.

- Child Birth: Same increase per child, max two events total.

Notify LIC within 90 days of the event. Pay an extra premium. No medical needed if under limits.

Riders and Extra Covers

Add LIC’s Accident Benefit Rider. Pays extra on accidental death or disability.

Check official site for rider details: LIC India Products.

How to Use LIC Bima Kavach Calculator

Calculator helps estimate premiums fast. Sites like sample.liccalculator.info offer free tools.

Steps to Calculate:

- Enter age (last birthday).

- Pick a death benefit option (level or increasing).

- Choose sum assured (min Rs. 2 Cr, multiples of Rs. 5L or 25L).

- Select premium mode and term.

- Note smoker status and gender.

Tool shows yearly/monthly premium. Example: 30-year-old male, non-smoker, Rs. 2 Cr level cover for 30 years—around Rs. 15,000-20,000 yearly (varies).

Try official resources or trusted calculators. Always verify with the LIC agent.

Sample Premium Examples

Here are easy examples for a 35-year-old non-smoker male, Rs. 2 crore cover, 30-year term.

| Option | Premium Mode | Yearly Premium (approx) |

|---|---|---|

| Level | Regular | Rs. 18,500 |

| Level | 10-year limited | Rs. 22,000 |

| Increasing | Regular | Rs. 21,000 |

| Level (Female) | Regular | Rs. 14,500 (special rate) |

The online rebates are reduced for higher sums: 2-3.5% off for Rs. 3-10 Cr. Premiums rise with age/smoking. Use a calculator for your numbers.

Tax Benefits You Get

Premiums qualify under Section 80C, up to Rs. 1.5 lakh deduction. Death benefit is tax-free under 10(10D).

Consult a tax advisor for personal rules.

How to Buy the Plan

- Visit LIC Official Website or branch.

- Use the online portal or call 022-68276827.

- Fill proposal and health docs. Medical test if needed.

- Pay the premium, get the policy bond.

Free look: 30 days to cancel.

Claims Process Made Simple

The nominee files a claim with the death certificate, policy docs, and bank details.

- TAT: 15 days if no probe, 45 days if needed.

- Forms at LIC Downloads.

Helpline: 022-68276827 or WhatsApp 8976862090.

Who Should Buy This Plan?

- Young families needing high cover cheaply.

- Parents planning for kids’ future.

- Those wanting cover till retirement or beyond.

Compare with Digi Term if online buying is preferred. LIC’s claim record is strong.

Renewal and Revival Rules

Pay on time. Lapsed? Revive within 5 years with due premiums and health proof.

No paid-up option.

Why Choose LIC Bima Kavach?

Trusted name, high sum assured, flexible features. Protects family financially.

Tips for Best Use

- Buy young for low premiums.

- Pick increasing if inflation is a worry.

- Use a calculator often to plan.

- Review every 5 years.

Download brochure: LIC Bima Kavach Page.

Frequently Asked Questions

What is LIC Bima Kavach Plan 887?

This is a pure term insurance plan offering high life cover up to age 100 with no maturity benefit. The minimum sum assured is Rs. 2 crore, ideal for family protection.

What are the eligibility rules?

Entry age is 18-65 years, policy term is 10 years to age 100, and sum assured starts at Rs. 2 crore. Women and non-smokers get lower premiums.

How do death benefits work?

On death during the term, nominees get the sum assured (level or increasing option) or the highest of 7x annual premium, 105% premiums paid, or absolute amount assured.

What is the increasing cover option?

In Option II, sum assured grows by 10% yearly from year 6 to 15, doubling the basic amount, then stays fixed.

Can I increase cover without medical tests?

Yes, via Life Stage Benefit: 25% increase (max Rs. 50 lakh) on marriage or child’s birth, up to two times total.

What premium payment modes are available?

Single pay, regular pay (full term), or limited pay (5, 10, 15 years). High sum assured rebates apply for covers over Rs. 2 crore.

How to buy or file a claim?

Buy via licindia.in or branches; claims need a death certificate and policy docs with 15-45 day processing. Helpline: 022-68276827.

Conclusion

LIC Bima Kavach Plan 887 offers strong, affordable protection for your family’s future. With high coverage up to age 100, flexible options, and easy calculators, it fits modern needs simply and reliably.