LIC Endowment Assurance Policy

Plan No. 14 | UIN: 512N020V01

Plan Information

Launch Date: Prior to 2000 (Legacy Plan)

Withdrawal Date: 01.01.2014

Plan Type: Endowment Assurance with Guaranteed Maturity & Death Benefits

Status: Discontinued - For existing policyholders only

Calculate Your Benefits

Premium & Benefit Details

- This plan was withdrawn from sale on 01.01.2014.

- Premium rates are approximate and based on standard rates. Actual premium may vary based on medical examination and other factors.

- Bonus rates shown are indicative (₹48 per ₹1000 SA) and actual rates are declared by LIC annually.

- Final Additional Bonus is estimated at 10% of Sum Assured and may vary at maturity.

- Death benefit includes Sum Assured + accrued bonus + final addition (if any).

- Loan facility available after 3 years up to 90% of surrender value.

- Grace period of 30 days is provided for premium payment.

LIC Endowment Assurance Policy Plan 14 was one of the classic offerings from Life Insurance Corporation of India, designed to combine life insurance protection with savings.

LIC Endowment Assurance Plan 14: Overview

LIC Endowment Assurance Plan 14 was a participating, non-linked savings and protection insurance plan. It was brought to the market to enable users to receive a lump sum amount on maturity while also ensuring financial protection for their loved ones in case of untimely demise.

Key Information

- Launch Date: This plan was active for several decades but was officially withdrawn on January 1, 2014.

- Withdraw Date: January 1, 2014 marked the last day for new purchases, after which only existing policyholders retained benefits.

Features and Benefits

Savings + Protection

This plan offered dual benefits—savings through a maturity bonus and protection via life insurance. The life cover was effective throughout the chosen policy term, making it suitable for financial security and goal fulfillment.

Death Benefit

In case of the policyholder’s death during the term (while premiums are up-to-date), the nominee receives the sum assured plus accrued bonuses.

Maturity Benefit

If the policyholder survives until the end of the policy term, they receive the sum assured, accumulated simple reversionary bonuses, and a final additional bonus (if applicable).

Loan Facility

Policyholders could avail a loan after paying premiums for at least three years, up to 90% of the policy’s surrender value.

Grace Period

Missed a premium? There was a grace period of 30 days before the policy lapsed, allowing policyholders extra time to continue their plan uninterrupted.

Who Was Eligible?

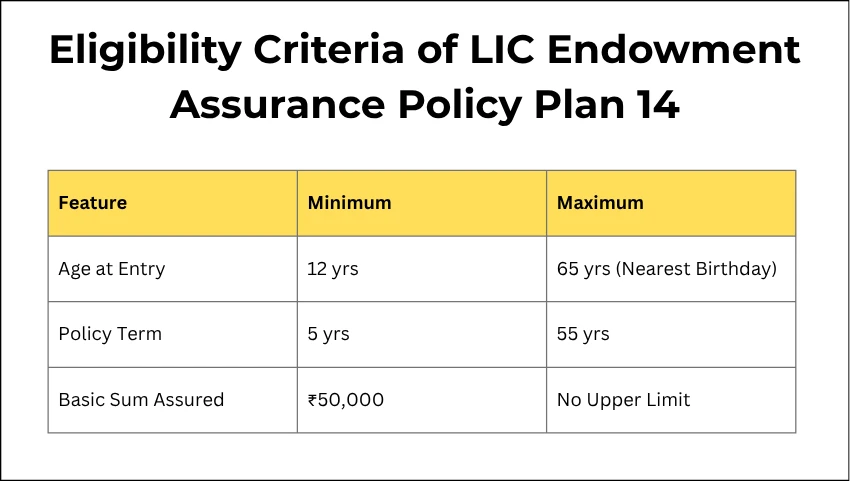

Eligibility Criteria

| Feature | Minimum | Maximum |

|---|---|---|

| Age at Entry | 12 yrs | 65 yrs (Nearest Birthday) |

| Policy Term | 5 yrs | 55 yrs |

| Basic Sum Assured | ₹50,000 | No Upper Limit |

The policy could be purchased by any individual within these parameters, making it highly accessible.

Premium Payment Modes

You could choose among yearly, half-yearly, quarterly, or monthly (through salary savings scheme or ECS) premium payments. Rebates were available for yearly (2%) and half-yearly (1%) modes, while quarterly and monthly premiums attracted no rebate.

How the LIC Endowment Assurance Plan 14 Calculator Works

A calculator for this plan allows you to input your basic details and estimate expected returns—both maturity and death benefits—making informed decisions possible without manual calculations.

Information Needed

- Age at entry (when you bought the plan)

- Policy term (number of years)

- Sum assured

- Premium payment frequency

- Bonus rates (based on LIC’s declared rates for Plan 14)

Calculator Output

The calculator displays maturity value, death benefit, total premium paid, and projected bonus. This is useful for policyholders to know what they can expect at the end of the policy term.

Example Calculation

Suppose:

- Age at Entry: 30 years

- Policy Term: 21 years

- Sum Assured: ₹10,00,000

Calculation:

- Sum Assured: ₹10,00,000

- Simple Reversionary Bonus (e.g., ₹48,000 x 21 years): ₹10,08,000

- Final Additional Bonus (e.g. 10% of Sum Assured): ₹1,00,000

- Total Maturity Benefit: ₹21,08,000

Surrender and Loan Features

Policyholders could surrender their plan after paying at least three years’ premiums. The surrender value is calculated using the formula: Surrender Value (Total Premiums Paid−First Year Premium)×Surrender Value Factor+Bonus Surrender Value

Loans could be taken up to 90% of the surrender value after three years of the policy.

Exclusions

Suicide within the first year or within one year of revival led to limited claim payments (typically 80% of premiums paid), without bonuses.

Advantages of the LIC Endowment Assurance Policy Plan 14

- Moderate premium, high liquidity, and savings orientation.

- Maturity returns include sum assured plus bonuses.

- Flexible term selection and premium payment modes.

- Loan facility after three years.

- Policy assignments for collateral purposes.

- Options to enhance coverage through riders.

Step-by-Step Guide: Using the LIC Endowment Assurance Plan 14 Calculator

- Visit a calculator website such as LICCalculator.info

- Select Plan 14 from available offerings.

- Enter your age at policy start, term of policy, sum assured, and premium payment mode.

- Input bonuses as per declared rates by LIC.

- Click “Calculate” to view your projected maturity amount and eligibility for benefits.

LIC Plan 14 vs LIC New Endowment Plan 814

| Feature | Plan 14 | New Endowment Plan 814 |

|---|---|---|

| Policy Term | 5-55 years | 12-35 years |

| Age at Entry | 12-65 years | 8-55 years |

| Sum Assured | ₹50,000 and above | ₹1,00,000 and above (multiples of 5000) |

| Death Benefit | Sum Assured plus bonus | Minimum 105% of premiums paid plus bonus |

| Maturity Benefit | Sum Assured plus bonus | Sum Assured plus bonus |

| Loan Facility | After 3 years | After 3 years |

Importance of LIC Endowment Assurance Plan 14 Calculator

Having a calculator is important for transparency. It helps policyholders:

- Know projected maturity and death benefits.

- Verify premium payments and bonus accruals.

- Simplify policy management without manual math or confusion.

Frequently Asked Questions

What is LIC Endowment Assurance Policy Plan 14?

It is a life insurance plan that combines savings and protection, offering a lump sum payment on maturity and financial security for your family in case of your death during the policy term.

When was LIC Plan 14 launched and withdrawn?

LIC Plan 14 was a long-standing plan but was withdrawn for new policy purchases on January 1, 2014.

What benefits do I get on maturity?

You get the sum assured plus accumulated simple reversionary bonuses and a final additional bonus at the end of the policy term.

What happens if the policyholder dies during the policy term?

The nominee receives the sum assured plus the accrued bonuses up to the date of death.

Can I surrender my LIC Plan 14 policy?

Yes, surrender is allowed after paying premiums for at least three years. The surrender value depends on premiums paid and bonuses accrued.

Conclusion

LIC Endowment Assurance Policy Plan 14 stood out for years as a simple, customer-friendly insurance-cum-savings tool. Through its flexible options, moderate premiums, bonuses, and easy loan features, it served the needs of Indian households.

While it is no longer offered for new policies, existing policyholders can use calculators to stay informed about their returns. If you’re searching for a similar plan today, look into LIC’s New Endowment Plan 814 for an updated experience.