LIC Jeevan Saathi Plus Plan 197

Unit Linked Insurance Plan for Couples

Plan Number: 197

UIN: 512L255V02

Launch Date: 29/06/2009

Withdrawal Date: 01/09/2010

Note: This plan has been withdrawn by LIC and is not available for new sales.

The LIC Jeevan Saathi Plus Plan 197 is a joint life insurance plan launched by Life Insurance Corporation of India (LIC) on June 29, 2009. It was designed specifically to provide life cover for married couples, ensuring financial protection for both partners under the same policy.

However, this plan was withdrawn from sale by LIC on September 1, 2010, meaning it is no longer available for new customers, though existing policies remain in force as per the terms of the plan.

Introduction to LIC Jeevan Saathi Plus Plan 197

The LIC Jeevan Saathi Plus Plan 197 is a unique insurance product tailored for couples, primarily aimed at offering financial security to both husband and wife under a single policy. The plan combined the advantages of an endowment and unit-linked insurance plan (ULIP), providing the dual benefit of protection and investment growth through market-linked fund performance.

Key Features of LIC Jeevan Saathi Plus Plan

- Joint Life Coverage: The plan covers two lives, usually spouses, under one policy, ensuring protection for the family in case of any unfortunate event affecting either or both policyholders.

- Premium Payment Flexibility: Annual, half-yearly, quarterly, and monthly premium payment modes were available, with monthly premiums payable only through ECS.

- Top-up Premiums: Policyholders could pay additional top-up premiums in multiples of Rs. 1000 during the policy tenure to increase the funds without increasing the sum assured.

- Partial Withdrawals: Allowed from the policyholder fund after completion of three policy years, giving flexibility to withdraw invested funds when needed.

- Fund Switching: The policy offered fund switching options to adjust the investment portfolio based on market conditions or risk appetite.

- Tax Benefits: Premiums paid were eligible for tax deduction under Section 80C of the Income Tax Act; maturity proceeds were tax-exempt under Section 10(10D).

- Minimum and Maximum Entry Ages: Entry age for policyholders ranged from 18 years minimum to 55 years maximum, with maximum maturity age up to 70 years.

- Policy Term: Policies were available for terms ranging typically from 10 to 20 years.

- Minimum Premium Amount: For regular premiums, minimum amounts typically started at Rs. 10,000 per annum (except monthly mode, where the minimum was Rs. 1,000 per month) with a minimum single premium of Rs. 40,000.

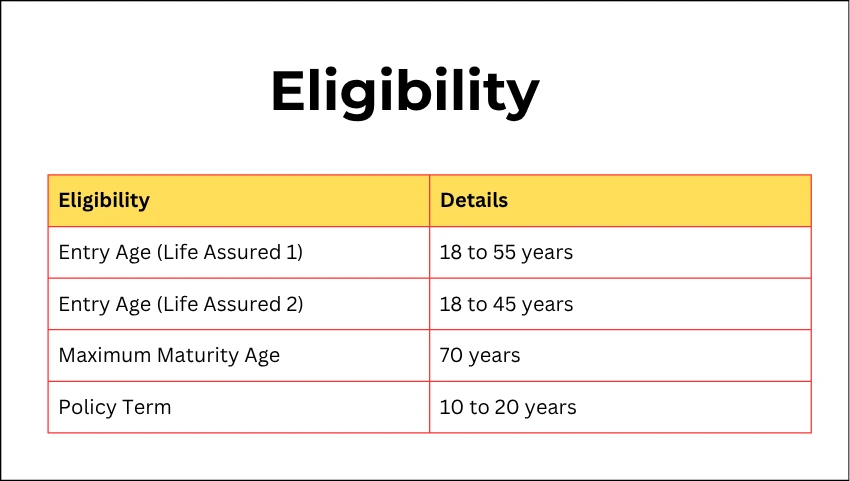

Eligibility

| Eligibility | Details |

|---|---|

| Entry Age (Life Assured 1) | 18 to 55 years |

| Entry Age (Life Assured 2) | 18 to 45 years |

| Maximum Maturity Age | 70 years |

| Policy Term | 10 to 20 years |

Benefits of LIC Jeevan Saathi Plus Plan

Maturity Benefit

On survival of either the Principal Life Assured or Spouse Life Assured till the end of the policy term, the policyholder would receive the fund value accumulated over the policy period. This included the initial premiums plus investment returns from the unit-linked funds chosen by the policyholder.

Death Benefit

- If one spouse passes away during the policy term, the assured amount is paid to the surviving spouse, and future premiums are waived off, allowing the policy to continue with the deceased spouse’s coverage ending.

- If the surviving spouse also dies during the policy term, the sum assured plus vested bonuses or fund value is paid to the nominees.

- The plan thus ensures continuous coverage, paying out benefits even if one or both insured individuals die during the policy term.

Revival and Surrender

- Policyholders could revive lapsed policies within two years of the first missed premium, subject to conditions.

- The policyholder’s fund value was payable upon surrender after completing three policy years.

- Partial withdrawals could be made after the 3rd anniversary of the policy, subject to minimum balance conditions.

LIC Jeevan Saathi Plus Plan 197 Calculator Explanation

The LIC Jeevan Saathi Plus Plan Calculator is used to estimate premiums, maturity amounts, and other benefits. It helps potential and existing policyholders understand their investment and returns better.

How the Calculator Works

- Input Parameters: Age of both insured persons, policy term, premium payment mode (regular or single), premium amount, etc.

- Calculation: Based on official LIC premium rates and fund growth assumptions, the calculator provides:

- Yearly or total premium payable.

- Estimated maturity fund value considering investment growth and bonuses.

- Death benefit projections.

- Surrender value estimates.

This enables policyholders to plan their finances effectively by projecting what they can expect at maturity or on a claim.

Important Dates of LIC Jeevan Saathi Plus Plan

- Launch Date: June 29, 2009

- Withdrawal Date: September 1, 2010

This means the product was available for sale for a little over one year before LIC withdrew it from the market. However, existing policies continue as per the original terms and conditions, with all benefits and privileges intact for the policyholders.

Who Should Consider LIC Jeevan Saathi Plus Plan?

This joint life insurance plan was best suited for married couples who wanted comprehensive protection combined with investment growth under a single policy. It was especially beneficial for:

- Couples looking for joint financial security.

- Those who wanted flexible premium payment options.

- Investors are interested in unit-linked plans with a combination of safety and market-linked returns.

- Policyholders wanting to cover both lives with one policy and reduce paperwork and premium costs.

Since the plan has been withdrawn, those interested in similar benefits should look into current LIC ULIPs or joint life insurance plans available in the market.

Alternatives After Withdrawal of Jeevan Saathi Plus Plan

With the LIC Jeevan Saathi Plus Plan withdrawn, customers can explore:

- Other LIC unit-linked plans are tailored for individual protection and investment.

- Joint life insurance plans from LIC and other insurers offering similar joint protection features.

- New endowment plus plans and money-back policies by LIC for maturity and survival benefits.

Always compare features, premium costs, and benefits before choosing the plan that suits your financial goals best.

Where to Find More Information and Official Sources

- LIC India Official Website: For authentic policy documents and plan details.

- LIC Customer Service: For queries on existing Jeevan Saathi Plus Plan policies.

- Insurance Regulatory and Development Authority (IRDA) updates on withdrawn plans.

- Trusted insurance advisor or financial planner for personalized advice.

Frequently Asked Questions

What is LIC Jeevan Saathi Plus Plan 197?

It is a joint life insurance plan by LIC that covers two lives, usually a married couple, under one policy, providing both life cover and investment benefits.

When was LIC Jeevan Saathi Plus Plan 197 launched?

The plan was launched on June 29, 2009.

Is LIC Jeevan Saathi Plus Plan 197 still available for new customers?

No, it was withdrawn from sale on September 1, 2010. Existing policies continue as per terms.

Who is eligible to take this plan?

Both lives should be aged between 18 and 55 years at entry, with a maximum maturity age of 70 years.

What are the premium payment options?

Premiums can be paid yearly, half-yearly, quarterly, or monthly via ECS. A single premium payment option is also available.

What benefits does the plan offer?

It offers maturity benefits on survival, death benefits for either or both insured lives, partial withdrawals, top-up premiums, and fund switching options.

Conclusion

The LIC Jeevan Saathi Plus Plan 197 was a beneficial joint life insurance policy catering to couples, combining life cover and ULIP benefits. Although no longer available for new purchase since September 2010, it served well by providing financial security, flexibility in premium payments, and investment growth potential.

The LIC Jeevan Saathi Plus Plan Calculator remains a useful tool for policyholders to estimate premiums and maturity benefits based on their inputs.