LIC Money Plus I Plan 193 Calculator

Calculate Your Investment Returns & Benefits (As per Official LIC Calculations)

📋 Enter Details

📈 Calculation Results

👆 Enter your details and click "Calculate Now" to see results

LIC Money Plus I Plan 193 was a unit-linked endowment plan introduced by LIC, blending insurance protection with wealth creation. Unlike traditional insurance plans, this ULIP allowed policyholders to invest their premiums in different funds managed by LIC, creating opportunities for capital growth while ensuring life protection throughout the policy term.

Launch Date & Withdraw Date

LIC Money Plus I Plan 193 was launched by LIC on 22nd May 2008. The plan was withdrawn and discontinued for new policy sales on 1st September 2010, making it part of LIC’s legacy ULIP products that are now closed to new enrollments.

Key Features of LIC Money Plus I Plan 193

- Dual benefit: life cover and wealth creation within the same plan.

- Choice of funds: Policyholders could invest in any of four funds: Bond Fund, Secured Fund, Balanced Fund, and Growth Fund—each with unique investment philosophies and risk-return trade-offs.

- Flexible premium: Premiums could be paid yearly, half-yearly, quarterly, or monthly (via ECS), with a minimum requirement of ₹5,000 annually.

- Partial withdrawal: Allowed any time after the third policy anniversary, subject to certain limits and conditions.

- Special riders: Optional Critical Illness Rider (up to ₹10 lakh), Accident Benefit Rider.

- Revival options: Policies could be revived within two years of lapse.

- Risk cover: The plan offered risk cover up to 30 times the annualized premium depending on the investment and age criteria.

- No bid-offer spread: Both bid and offer prices of units were equal to the Net Asset Value (NAV), which was calculated daily.

Investment and Fund Options

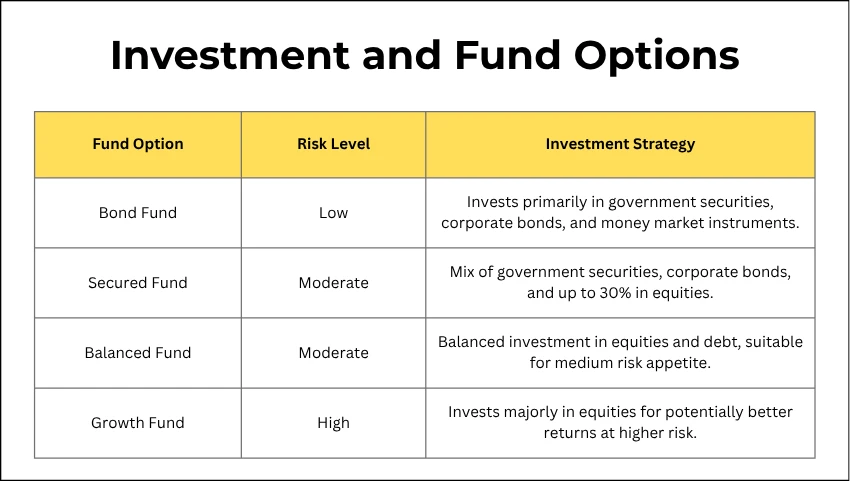

Policyholders had the flexibility to park their money in any of the following four funds, each with varying risk profiles and expected returns:

| Fund Option | Risk Level | Investment Strategy |

|---|---|---|

| Bond Fund | Low | Invests primarily in government securities, corporate bonds, and money market instruments. |

| Secured Fund | Moderate | Mix of government securities, corporate bonds, and up to 30% in equities. |

| Balanced Fund | Moderate | Balanced investment in equities and debt, suitable for medium risk appetite. |

| Growth Fund | High | Invests majorly in equities for potentially better returns at higher risk. |

The Net Asset Value (NAV) of each fund type varied daily depending on market conditions and fund management charges. External sources like the official LIC website list historic NAVs for reference.

How the Calculator Works

An LIC Money Plus I Plan 193 calculator is a handy web tool designed to estimate potential returns, maturity value, and fund value under this policy. It uses input parameters such as

- Premium amount and payment frequency

- Policy term

- Chosen fund type (Bond, Secured, Balanced, Growth)

- Age at entry

- Sum Assured

- Existing fund value (if applicable)

- Applicable charges and NAV

The calculator processes these details to provide output, including:

- Year-wise premium deposits

- Projected fund value for each year

- Maturity value estimation

- Coverage details

- Partial withdrawal effects (if any)

Such calculators simplify the process for users to understand what they might expect as outcomes, guiding both investment planning and insurance adequacy.

Step-by-Step Calculation Example

Suppose a policyholder chooses a premium of ₹10,000 per year for 15 years, invests in the Balanced Fund, and is aged 30 when taking the policy.

- Yearly Premium: ₹10,000

- Policy Term: 15 years

- Chosen Fund: Balanced Fund (NAV changes daily; assume a hypothetical average NAV for calculation.)

- Charges: The calculator deducts allocation, mortality, fund management, rider, and possible service tax charges from the fund value.

- Unit Allocation: The net premium after deductions is used to purchase units at applicable NAV.

- Projected Fund Value: For each year, new units are added via fresh premium payments, and existing units’ value is updated as per NAV growth.

- Maturity Value: After 15 years, the final fund value (all units multiplied by current NAV) is payable as maturity proceeds.

Premium Payment Options

Premiums for the LIC Money Plus I Plan 193 could be paid using any of these flexible modes:

- Yearly

- Half-Yearly

- Quarterly

- Monthly (including via Electronic Clearing Service – ECS)

The minimum premium amount for yearly payment was ₹5,000, and for monthly payment it was ₹1,000 (in multiples of ₹250 thereafter). Annualized premium determined both investment and risk cover benefits. The maximum sum assured depended on the annual premium and the applicant’s age.

Important Policy Charges

Several charges were deducted by LIC to manage the insurance and investment aspects of the plan:

- Premium Allocation Charge: Deducted as a percentage of premium before investment for buying units. The first year had a higher charge, then lower for subsequent years.

- ₹5,000 to ₹75,000/year: 26.5% (first year), 5.0% (years 2–3), 2.5% thereafter

- Above ₹75,000/year: 25.5%/24%/23% depending on band

- Mortality Charge: Monthly deduction for life cover, dependent on age and sum assured.

- Fund Management Charge: Regular deduction from NAV for management of invested funds.

- Rider Charges: For optional critical illness or accident benefit riders.

- Switching Charge: Charged after four free switches per year if the policyholder changes the fund option.

- Miscellaneous Charges: For alterations and service taxes (the effective rate was 12.36% at launch).

Risk Cover Details

This plan provided risk cover throughout the policy term, which included:

- Sum Assured up to 30 times the annualized premium (subject to age and underwriting)

- Minimum Sum Assured: 5 times annual premium

- Maximum Sum Assured: 30 times annual premium, as per eligibility

- Extended risk cover post-revival if policy lapsed and revived within two year

- Accident Benefit and Critical Illness riders offered additional protection

Maturity and Death Benefits

At maturity, the policyholder would receive the total fund value, calculated as the total number of units multiplied by the prevailing NAV of the chosen fund. There was no guaranteed return beyond the actual investment performance of the NAV.

In case of the unfortunate death of the policyholder during the term (while the policy was in force):

- The nominee gets the higher of the basic sum assured or the policyholder’s fund value (subject to conditions and cover in force).

- Riders, if opted, pay additional cover for accident benefits and/or critical illness.

For partial withdrawals (allowed after three years):

- The sum assured would reduce for two years proportionally to the withdrawal amount.

Partial Withdrawals and Surrender Rules

Partial withdrawals could be made after completing three policy years, subject to:

- Minimum withdrawal amount and remaining fund balance maintained as per policy rules.

- On surrender (after three years), the policyholder received the fund value, but no amount was payable within the first three years.

Compulsory surrender occurred if the policy was not revived post-lapse, and payout was made after three years as per rules.

Frequently Asked Questions

What is LIC Money Plus I Plan 193?

LIC Money Plus I Plan 193 was a unit-linked insurance plan (ULIP) from LIC combining life insurance cover with investment in multiple fund options for wealth creation over the policy term.

When was LIC Money Plus I Plan 193 launched and withdrawn?

It was launched on 22nd May 2008 and withdrawn for new business on 1st September 2010.

What are the fund options available under this plan?

The plan had four funds: Bond Fund, Secured Fund, Balanced Fund, and Growth Fund, each with a different risk and return profile.

How is the premium paid under this plan?

Premiums could be paid yearly, half-yearly, quarterly, or monthly (including ECS), with a minimum yearly premium of ₹5,000.

Can I make partial withdrawals from this plan?

Yes, partial withdrawals were allowed after the completion of three policy years, subject to the rules and minimum balance requirements.

Conclusion

LIC Money Plus I Plan 193 stood as a prominent ULIP product, offering flexibility, combined insurance and investment benefits, and the ability to tailor coverage and investment strategy to individual needs.

Though discontinued in 2010, its legacy is significant, highlighting important principles of ULIPs and providing benchmarks for newer products. Use online calculators for practical fund and return estimation, and refer to official LIC sources for historic NAVs or further details about legacy plans.