LIC New Jeevan Dhara I Plan 148 Calculator

Plan Number: 148

UIN: 512N205V01

Plan Type: Single Premium Deferred Annuity Plan

Launch Date: Available (Specific date not publicly listed)

Withdrawal Date: 01/01/2012

Calculation Results

The LIC New Jeevan Dhara I Plan 148 was a popular pension plan launched by the Life Insurance Corporation of India (LIC), designed to provide a steady stream of income after retirement through an annuity.

What is LIC New Jeevan Dhara I Plan 148?

The New Jeevan Dhara I Plan 148 was a deferred annuity pension plan from LIC, targeted at individuals looking to secure their retirement with a long-term financial instrument. It worked by collecting regular premiums over a specified term and, upon maturity, converting the accumulated amount into periodic pension payments.

The plan aimed to ensure financial independence in one’s golden years, eliminating the anxiety of outliving one’s savings. It was well-suited for salaried professionals, self-employed individuals, and anyone desiring a lifetime pension.

Plan Launch and Withdrawal Dates

- Launch Date: LIC introduced the LIC New Jeevan Dhara I Plan 148 in the late 1990s as part of its pension product portfolio to address growing awareness around retirement planning in India.

- Withdrawal Date: The plan was withdrawn by LIC in early 2002, making way for newer pension schemes with revised benefits and improved terms.

For the most current annuity offerings from LIC, users should refer to the official LIC Pension Plans page.

Overview of Plan Features

Key Features

- Type: Deferred annuity plan

- Entry Age: Minimum 18 years; Maximum 65 years

- Policy Term: Flexible; user-selected (10 years or more)

- Premium: Payable monthly, quarterly, half-yearly, or yearly

- Maturity Benefit: Pension starts after policy term

- Tax Benefits: Section 80CCC of Income Tax Act (subject to prevailing laws)

Eligibility

To buy the New Jeevan Dhara I Plan 148, an individual needed to:

- Be within the specified entry age

- Choose the premium amount and policy term based on retirement goals

- Nominate beneficiary for death benefit

How the Jeevan Dhara I Plan Works

The plan operated as a systematic accumulation of premiums with interest, resulting in a lump-sum corpus at the end of the policy term. Upon maturity, the corpus was annuitized (converted into a pension), payable for life or a fixed period.

Example Flow

- A 30-year-old individual starts the policy for 25 years with an annual premium of ₹20,000.

- After 25 years, the accumulated corpus is annuitized.

- Pension starts, payable monthly/yearly, depending on the user’s choice.

The plan allowed pension receipt options such as

- For life

- For life with return of original corpus

- For a stipulated period (e.g., 15/20 years)

Calculation Methodology

Steps for Using the Calculator

- Input age, policy term, and premium amount.

- Calculator uses plan rules to project corpus accumulation: Corpus at Maturity=Corpus at Maturity=P×r(1+r)n−1

- Where:

P=P =P= annual premium

r=r =r= assumed interest rate (set by LIC)

n=n =n= number of years paid - Annuitization:

At maturity, the corpus is converted using LIC’s annuity rates. Annual Pension = Corpus × Annuity Rate - Annual Pension=Corpus×Annuity Rate Annuity rates vary by age and prevailing market conditions.

Step-by-Step Guide to Using Plan 148 Calculator

1. Enter Personal Details

- Age at Entry

- Desired Policy Term

- Yearly Premium

2. Accumulation Phase

The calculator computes the corpus accumulation using a compound interest approach based on plan rules.

3. Annuity Selection

Choose the desired annuity option (lifetime, fixed period, or return of corpus).

4. Pension Calculation

The calculator multiplies the corpus by LIC’s specified annuity factor for the chosen option.

5. Output

Displays the anticipated annual/monthly pension, along with a breakdown of the premium paid, corpus at maturity, and start date of pension payouts.

LIC New Jeevan Dhara I Plan 148 Calculator Example

Let’s walk through a sample calculation for clarity.

Scenario:

- Entry Age: 30 years

- Policy Term: 25 years

- Premium: ₹20,000 yearly

Calculation Steps:

- Calculate total premium paid:

20,000×25=₹5,00,000 - Accumulate corpus:

Assuming LIC’s interest rate is 6%: Corpus=20,000×0.06(1+0.06) 25−1 = 20,000×0.06(4.2919)−1 =20,000×54.865=₹10,97,300 - Annuitize:

Annuity rate (example): 7% Annual Pension=10,97,300×0.07=₹76,811

The actual rates and maturity amount may vary based on LIC’s declared rates at the time of purchase/maturity; always verify via official calculators and sources.

Benefits of LIC New Jeevan Dhara I Plan 148

Guaranteed Pension

Pension starts at the end of the policy term, ensuring income security after retirement.

Flexible Premiums

Choose frequency as per convenience—monthly, quarterly, half-yearly, or yearly.

Protection

If the policyholder dies during the policy term, the nominee gets the premium(s) paid with added interest, ensuring the family is taken care of.

Tax Benefits

Premiums qualify for deductions under Section 80CCC of the Income Tax Act (as per prevailing rules).

Customizable Annuity Options

Offers annuity for life, fixed period, and return of corpus flexibility.

Drawbacks and Considerations

Changing Interest Rates

Returns depend on prevailing interest rates; since the plan is discontinued, newer plans have updated rates and benefits.

Fixed Returns

Compared to market-linked pension plans, returns are fixed, which may not always beat inflation.

Lack of Policy Loans

Unlike many other life insurance plans, policy loans were not available with Plan 148.

Why Use a Jeevan Dhara I Plan Calculator?

The calculator is a practical tool for:

- Estimating pension amounts

- Comparing premium and corpus outcomes for various policy terms and entry ages

- Informed financial planning

It simplifies complex actuarial calculations, letting users focus on their retirement goals.

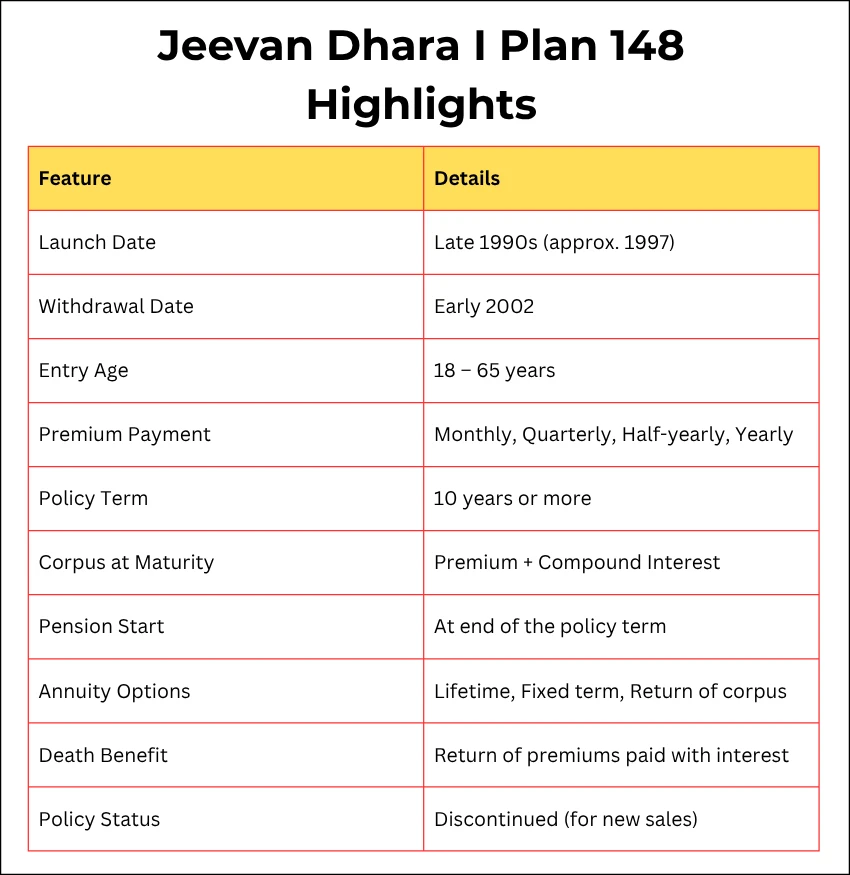

Summary Table: LIC New Jeevan Dhara I Plan 148 Highlights

| Feature | Details |

|---|---|

| Launch Date | Late 1990s (approx. 1997) |

| Withdrawal Date | Early 2002 |

| Entry Age | 18 – 65 years |

| Premium Payment | Monthly, Quarterly, Half-yearly, Yearly |

| Policy Term | 10 years or more |

| Corpus at Maturity | Premium + Compound Interest |

| Pension Start | At end of the policy term |

| Annuity Options | Lifetime, Fixed term, Return of corpus |

| Death Benefit | Return of premiums paid with interest |

| Policy Status | Discontinued (for new sales) |

Frequently Asked Questions (FAQs)

Is the LIC New Jeevan Dhara I Plan 148 still available for new policyholders?

No, the plan was withdrawn in early 2002. New policies are no longer issued under this plan, but existing policyholders continue to receive benefits.

What was the main purpose of the New Jeevan Dhara I Plan 148?

It was a deferred annuity pension plan designed to provide a guaranteed pension after retirement, ensuring a steady income stream.

What was the minimum and maximum entry age for this plan?

The minimum entry age was 18 years and the maximum was 65 years at the time of purchase.

How was the pension amount calculated upon maturity?

The pension was calculated by converting the accumulated corpus through LIC’s annuity rates, which depended on age and the annuity option chosen.

What happened if the policyholder died before maturity?

In such a case, the nominee received the premiums paid along with accrued interest, as per the plan’s provisions.

Were there any tax benefits associated with this plan?

Yes, premiums paid qualified for tax deductions under Section 80CCC of the Income Tax Act, subject to prevailing tax laws.

Conclusion

LIC New Jeevan Dhara I Plan 148 was a pioneering deferred pension plan that set the foundation for retirement planning in India. While no longer available for purchase, understanding its mechanism is valuable for those with existing policies or for anyone seeking insight into historical annuity products.

For those currently planning retirement, newer LIC plans build upon Jeevan Dhara’s structure with added flexibility and improved benefits. Always use reputable calculators and seek information only from trusted financial and insurance sources.